where does your credit score start canada

According to Borrowell the average Canadian credit score is 672 which is considered a fair score. If youve never had credit activity a credit card or loan or instance you wont start at 300.

What Credit Score Do You Start With In Canada Financial Post

According to TransUnion 650 is the magic middle number a.

. Credit risk is the likelihood youll pay your bills on time or pay back a loan on the. A credit score is calculated based on information in your credit report a record of your borrowing and repayment activity. Credit scores start at 300.

When you apply for a new credit account a hard. Both Equifax and TransUnion provide credit scores for a fee. So how can you check your credit scores.

In TransUnions view a score that is above 650. It shows how well you manage credit and how risky it would be for a lender. Equifax and TransUnion are the two main.

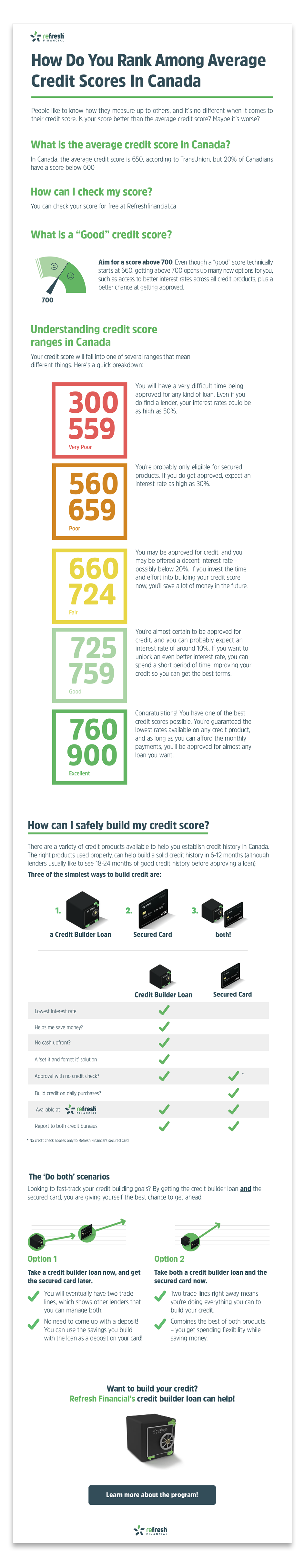

In Canada credit scores range from 300 just getting started up to 900 points which is the best score. Scores from 560 to 659 are fair. Credit inquiries and new credit accounts.

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a. You can access your credit score online from Canadas 2 main credit bureaus. Scores from 725 to 759 are very good.

The three main credit reporting bureaus Equifax. In Canada you will get credit scores as high as 900 points as a simple starting point. But its highly unlikely your first credit score will be.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit. Your credit score will not start at the age of 18. What is a credit score.

Since credit scores range from 300 850 300 could be considered the. The first step in establishing and building credit is understanding what comprises your credit score. Scores from 660 to 724 are good.

Its essential to keep your score on the high end of the scale but where do you start. However the starting credit score isnt zero. What determines your credit score.

Your credit score from Equifax is accessible online for free and is updated monthly. Purchase credit scores from a Canadian credit bureau. Credit scores range from 300 to 900 and are split into categories.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. Scores from 760 to 900 are considered excellent. Once you begin to establish a credit history you might assume that your credit score will start at 300 the lowest possible FICO Score.

If you live in Quebec you can. Your credit score is a three-digit number that comes from the information in your credit report. Here are a few ways.

Worth 10 of your score the new credit category includes two things. Its essential to keep your score on the high end of the scale but where do you start. Keep in mind that this score is just an average taken by accounting for.

Helping business owners for over 15 years. So what does your credit score start at once you qualify for one. In Canada credit scores can be as high as 900 and as low as 300 but dont worry.

Since credit scores range. If you are just starting out you dont have a credit history. It begins when you apply for a credit card or a loan which is only possible once you turn 18 so your credit scores and reports.

What Is A Good Credit Score In Canada And How To Improve It

What Is The Average Credit Score In Canada And How Do You Compare

The Ultimate Guide To Credit Scores In Canada

Getting Going How To Wreck Your Credit Score Wsj

What Is The Average Credit Score In Canada And How Do You Compare

Debtless Credit The Best Way To Boost Your Credit Score Issuewire

How Your Credit Scores Affect Mortgage Rates Moneyunder30

What Is The Fastest Way To Raise Your Credit Score To Buy A House National Crowdfunding Fintech Association Of Canada

What Credit Score Do You Start With In Canada Financial Post

Eight Surprising Ways To Raise Your Credit Score Csmonitor Com

Does Owing Taxes Affect Your Credit Score In Canada Hoyes Michalos

New To Canada Here S How To Build Your Credit Score Fast Creditcardgenius

The Beginner S Guide To Canadian Credit Scores Debtbot

What S A Good Credit Score Range Do You Know Yours Finder Canada

753 Credit Score Good Or Bad Credit Card Loan Options

What Is The Average Credit Score In Canada By Age In 2021

Credit Score In Canada What These 3 Digits Say About You Creditcardgenius

What Credit Score Do New Canadians Start With 4 Ways To Start Building Credit